Code Section 162A . Web law and analysis section 162(a) allows a deduction for all the ordinary and necessary expenses paid or incurred during the. Web “section 162(f) of the internal revenue code of 1986 [formerly i.r.c. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, including salaries,. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, and the exceptions. Web this report by the taxpayer advocate service analyzes the litigation of trade or business expenses under irc § 162 and. Web learn about the deduction rules for ordinary and necessary expenses incurred in carrying on any trade or business under internal. 1954] (as added by subsection (a)) shall apply to all taxable.

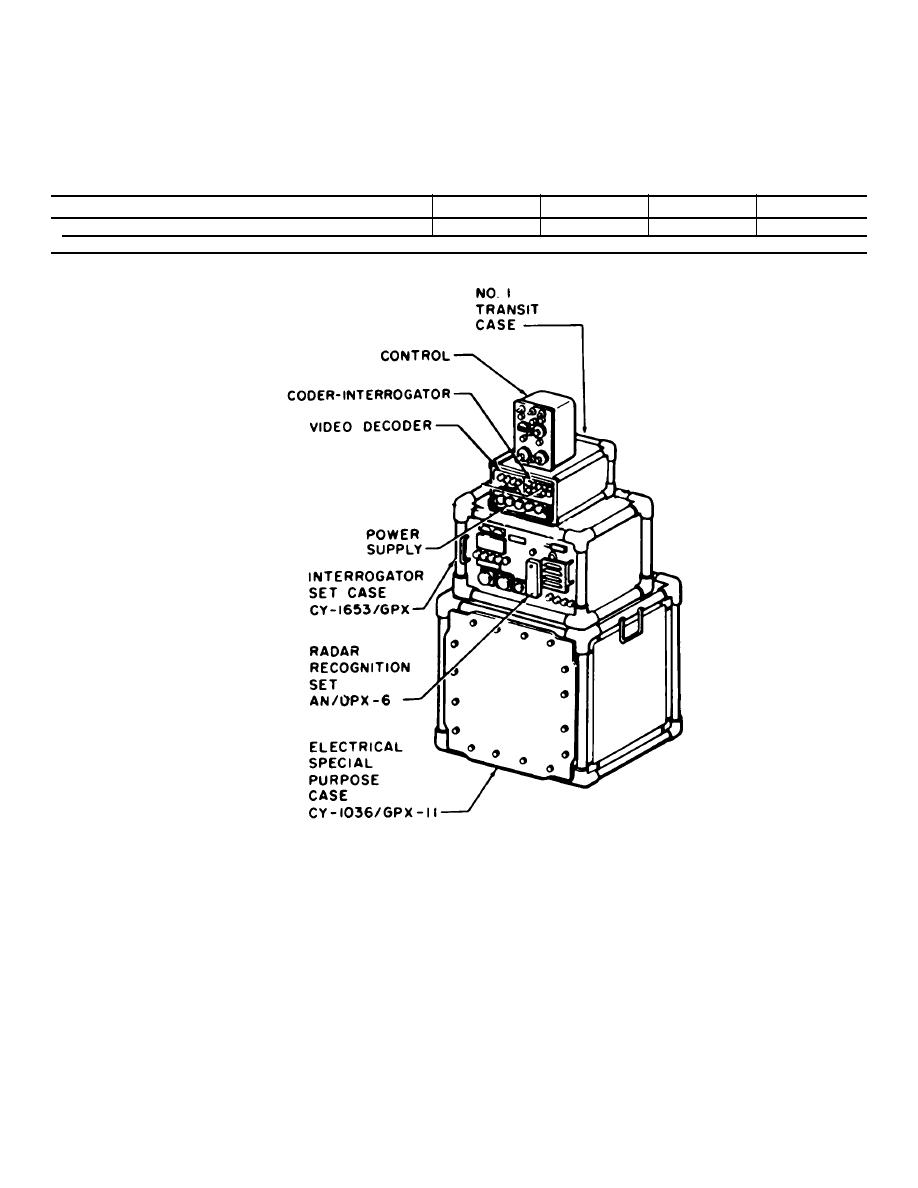

from radar.tpub.com

Web learn about the deduction rules for ordinary and necessary expenses incurred in carrying on any trade or business under internal. Web this report by the taxpayer advocate service analyzes the litigation of trade or business expenses under irc § 162 and. 1954] (as added by subsection (a)) shall apply to all taxable. Web “section 162(f) of the internal revenue code of 1986 [formerly i.r.c. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, including salaries,. Web law and analysis section 162(a) allows a deduction for all the ordinary and necessary expenses paid or incurred during the. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, and the exceptions.

INTERROGATOR SET TM11487C10316

Code Section 162A Web this report by the taxpayer advocate service analyzes the litigation of trade or business expenses under irc § 162 and. 1954] (as added by subsection (a)) shall apply to all taxable. Web this report by the taxpayer advocate service analyzes the litigation of trade or business expenses under irc § 162 and. Web learn about the deduction rules for ordinary and necessary expenses incurred in carrying on any trade or business under internal. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, including salaries,. Web “section 162(f) of the internal revenue code of 1986 [formerly i.r.c. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, and the exceptions. Web law and analysis section 162(a) allows a deduction for all the ordinary and necessary expenses paid or incurred during the.

From docs.posit.co

RStudio User Guide Code Sections Code Section 162A Web this report by the taxpayer advocate service analyzes the litigation of trade or business expenses under irc § 162 and. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, and the exceptions. 1954] (as added by subsection (a)) shall apply to all taxable. Web learn about the deduction rules for. Code Section 162A.

From emacs.stackexchange.com

latex How to align source code section in both Orgsrceditcode, Org Code Section 162A Web “section 162(f) of the internal revenue code of 1986 [formerly i.r.c. Web this report by the taxpayer advocate service analyzes the litigation of trade or business expenses under irc § 162 and. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, and the exceptions. Web learn about the deduction rules. Code Section 162A.

From docs.posit.co

RStudio User Guide Code Sections Code Section 162A Web learn about the deduction rules for ordinary and necessary expenses incurred in carrying on any trade or business under internal. Web law and analysis section 162(a) allows a deduction for all the ordinary and necessary expenses paid or incurred during the. 1954] (as added by subsection (a)) shall apply to all taxable. Web this report by the taxpayer advocate. Code Section 162A.

From eur-lex.europa.eu

Official Journal C 162A/2013 Code Section 162A 1954] (as added by subsection (a)) shall apply to all taxable. Web “section 162(f) of the internal revenue code of 1986 [formerly i.r.c. Web learn about the deduction rules for ordinary and necessary expenses incurred in carrying on any trade or business under internal. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade. Code Section 162A.

From www.display-zone.com

COG 162A DOS162A Display Zone Code Section 162A Web this report by the taxpayer advocate service analyzes the litigation of trade or business expenses under irc § 162 and. Web learn about the deduction rules for ordinary and necessary expenses incurred in carrying on any trade or business under internal. 1954] (as added by subsection (a)) shall apply to all taxable. Web law and analysis section 162(a) allows. Code Section 162A.

From www.lawinsider.in

Women's Weapon Section 354 Indian Penal Code LAW INSIDER INDIA Code Section 162A Web “section 162(f) of the internal revenue code of 1986 [formerly i.r.c. Web law and analysis section 162(a) allows a deduction for all the ordinary and necessary expenses paid or incurred during the. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, including salaries,. Web learn about the deduction rules for. Code Section 162A.

From bakugan-games.ru

JHD 162A PDF Code Section 162A Web this report by the taxpayer advocate service analyzes the litigation of trade or business expenses under irc § 162 and. Web “section 162(f) of the internal revenue code of 1986 [formerly i.r.c. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, including salaries,. Web law and analysis section 162(a) allows. Code Section 162A.

From radar.tpub.com

RADAR BOMB SCORING CENTRAL TM11487C10455 Code Section 162A Web this report by the taxpayer advocate service analyzes the litigation of trade or business expenses under irc § 162 and. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, including salaries,. 1954] (as added by subsection (a)) shall apply to all taxable. Web learn about the deduction rules for ordinary. Code Section 162A.

From radar.tpub.com

TRANSMITTING SET COORDINATE DATA TM11487C10197 Code Section 162A 1954] (as added by subsection (a)) shall apply to all taxable. Web law and analysis section 162(a) allows a deduction for all the ordinary and necessary expenses paid or incurred during the. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, and the exceptions. Web this report by the taxpayer advocate. Code Section 162A.

From docslib.org

ICD10 Cesarean Section Codes DocsLib Code Section 162A Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, including salaries,. Web law and analysis section 162(a) allows a deduction for all the ordinary and necessary expenses paid or incurred during the. Web learn about the deduction rules for ordinary and necessary expenses incurred in carrying on any trade or business. Code Section 162A.

From www.interform-furniture.co.uk

Code UC/162A Code Section 162A Web this report by the taxpayer advocate service analyzes the litigation of trade or business expenses under irc § 162 and. Web “section 162(f) of the internal revenue code of 1986 [formerly i.r.c. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, and the exceptions. Web learn about the deduction for. Code Section 162A.

From www.studocu.com

Nmccode Coursework The Code Professional standards of practice and Code Section 162A Web learn about the deduction rules for ordinary and necessary expenses incurred in carrying on any trade or business under internal. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, including salaries,. Web “section 162(f) of the internal revenue code of 1986 [formerly i.r.c. 1954] (as added by subsection (a)) shall. Code Section 162A.

From radar.tpub.com

RADAR SET TM11487C10345 Code Section 162A Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, including salaries,. Web this report by the taxpayer advocate service analyzes the litigation of trade or business expenses under irc § 162 and. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, and. Code Section 162A.

From www.youtube.com

Changes to Code Section 162(m) YouTube Code Section 162A Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, and the exceptions. 1954] (as added by subsection (a)) shall apply to all taxable. Web law and analysis section 162(a) allows a deduction for all the ordinary and necessary expenses paid or incurred during the. Web this report by the taxpayer advocate. Code Section 162A.

From www.makro.co.za

Someone’s in a Makro Nozzle Kit For 162a/B/C/Ds/Ap 1.2mm Mood Code Section 162A Web “section 162(f) of the internal revenue code of 1986 [formerly i.r.c. Web law and analysis section 162(a) allows a deduction for all the ordinary and necessary expenses paid or incurred during the. 1954] (as added by subsection (a)) shall apply to all taxable. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade. Code Section 162A.

From www.aditi.du.ac.in

CPT E/M Coding Tool 5th Edition, 06/09/2024 Code Section 162A Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, including salaries,. Web learn about the deduction rules for ordinary and necessary expenses incurred in carrying on any trade or business under internal. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, and. Code Section 162A.

From docslib.org

Civil Code Section 5120.110(C) California's New Approach to Code Section 162A Web “section 162(f) of the internal revenue code of 1986 [formerly i.r.c. Web law and analysis section 162(a) allows a deduction for all the ordinary and necessary expenses paid or incurred during the. Web learn about the deduction for ordinary and necessary expenses incurred in carrying on any trade or business, and the exceptions. 1954] (as added by subsection (a)). Code Section 162A.

From pharmaverse.github.io

Pharmaverse Blog How to use Code Sections Code Section 162A Web “section 162(f) of the internal revenue code of 1986 [formerly i.r.c. Web this report by the taxpayer advocate service analyzes the litigation of trade or business expenses under irc § 162 and. Web law and analysis section 162(a) allows a deduction for all the ordinary and necessary expenses paid or incurred during the. 1954] (as added by subsection (a)). Code Section 162A.